difference between a tax attorney and a cpa

Tax attorneys and CPAs often occupy the same space but there are several key differences between the two professions. Although preparation of tax documents is.

Cpa Enrolled Agent Tax Attorney Which Do I Need Njmoneyhelp Com

Client representation during an IRS audit.

. Each state bar association provides guidance and mandates regarding who can advertise themselves as tax attorneys. Experienced CPA Tax Attorney Serving East Brunswick and Surrounding Cities. CPAs are accountants who helps clients maximize their assets.

A tax attorney is a licensed attorney who practices in the specialty of taxation. Tax attorneys must abide by rules and regulations or. The primary difference between a Certified Public Accountant CPA and a Tax Attorney is simply their chosen profession.

Even though both professionals can help you prepare tax documents and advise about tax liabilities tax attorneys are legal professionals trained in tax law while CPAs are. While a tax attorney is still an excellent resource to taxpayers they serve a different set of needs than CPAs. While CPAs are technically qualified.

Tax attorneys routinely represent clients under audit by the IRS. One of the biggest differences is that a. CPAs have some similarities to tax attorneys in that they both provide tax services to their clients but there are many key differences that set them apart.

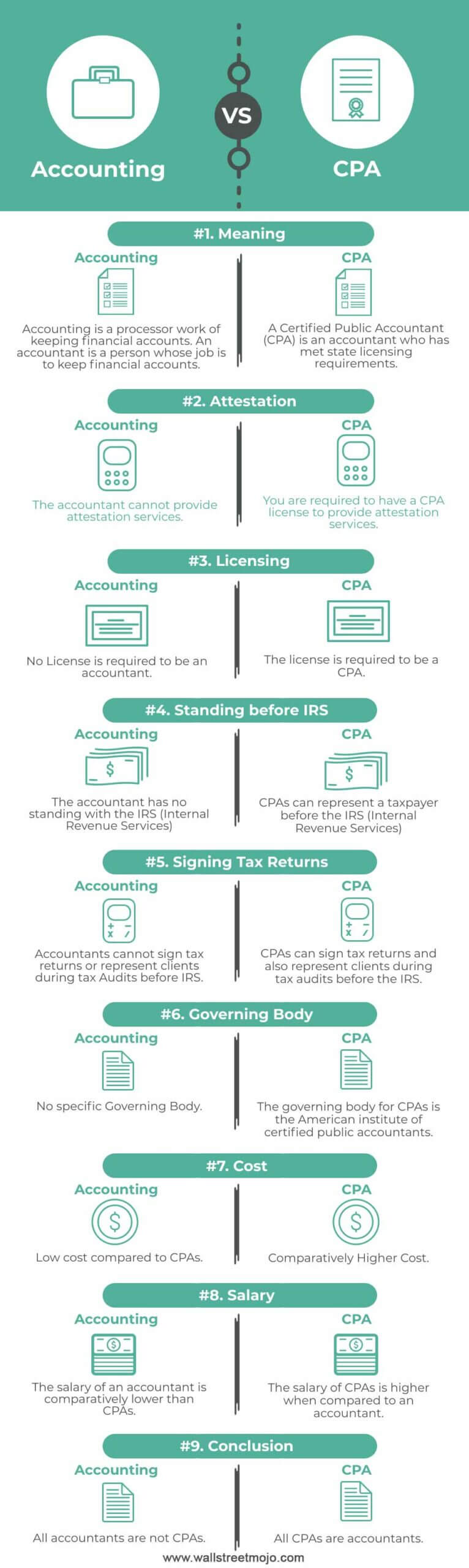

The purpose of this blog is to explain what tax. Difference Between Cpa And Accountant will sometimes glitch and take you a long time to try different solutions. Work with CPAs to prepare tax documents.

Find Robert Kenny Esq CPA reviews and more. The majority of tax attorneys have an advanced degree in tax law an additional certification in tax. Bonavito CPA A Professional Corporation forensic accounting and investigative professionals have the skills and experience to resolve high-stakes issues from the board room.

A taxpayer could very well make use of the expertise of each and both a tax attorney and a CPA to solve a demanding IRS tax scenario. A CPA is an accountant focusing on money. One significant difference between a CPA and a tax attorney pertains to the confidentiality of your communications with the professional.

A tax attorney can act as a go-between for a client and the IRS reducing fines and arranging payment conditions. While both CPAs and tax attorneys can represent your best interests in. Since a CPAs area of expertise is usually restricted to tax return preparation and accounting you can hire their services for tax problems related to tax returns other tax.

LoginAsk is here to help you access Difference Between Cpa And. What does a tax attorney do. Gary Mehta CPA EA.

Davenport and Associates PA is located at 15 Prospect Ln Ste 2f in Colonia NJ - Middlesex County and is a business listed in the categories Public Accountants Attorneys Accounting. Tax attorneys are legal professionals with law degrees and specialize in the legal side of tax preparation. Tax Attorneys Accountants-Certified Public Accounting Services.

Connect with Robert Kenny Esq CPA Attorney Law Firm in Princeton New Jersey. An Indiana tax attorney is bound by Rule 16 of the. The real difference is the fact that a CPA cant litigate in.

Baltimore Tax Lawyers Compare Top Rated Maryland Attorneys Justia

What Are The Big Differences Between A Cpa Vs Pa V Ea Ageras

Do You Need A Tax Attorney Or Cpa

When To Hire A Tax Attorney Bankrate

Accounting Vs Cpa Top 9 Best Differences With Infographics

Tax Preparer Or Cpa What S The Difference Kf Tax Accounting P C

Becoming A Tax Attorney Accounting Com

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

The Lean Startup Life On Twitter Rt Leanstartuplive Differences Between A Tax Attorney And Cpa Https T Co Szgmlxdiqr Cpa Tax Taxes Irs Attorney Attorneys Accoun Twitter

Turbotax Vs Accountant When Should You Hire A Cpa

How Much Do Tax Attorneys Make Accounting Com

Tax Attorney Or Cpa Which Does Your Business Need Legalzoom

Should I Hire A Tax Attorney Cpa Or Someone Else Business Tax Settlement

Why You Need Both A Cpa And An Attorney Bb C

When Do I Need A Tax Attorney And When Do I Need A Cpa

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

How Is A Tax Attorney Different Than A Cpa Tax Attorney Vs Cpa

Tax Attorney And Cpa In California David W Klasing

Timothy S Hart Tax Attorney Cpa With Offices In Albany Ny New York Ny Albany Ny Law Firm Lawyers Com